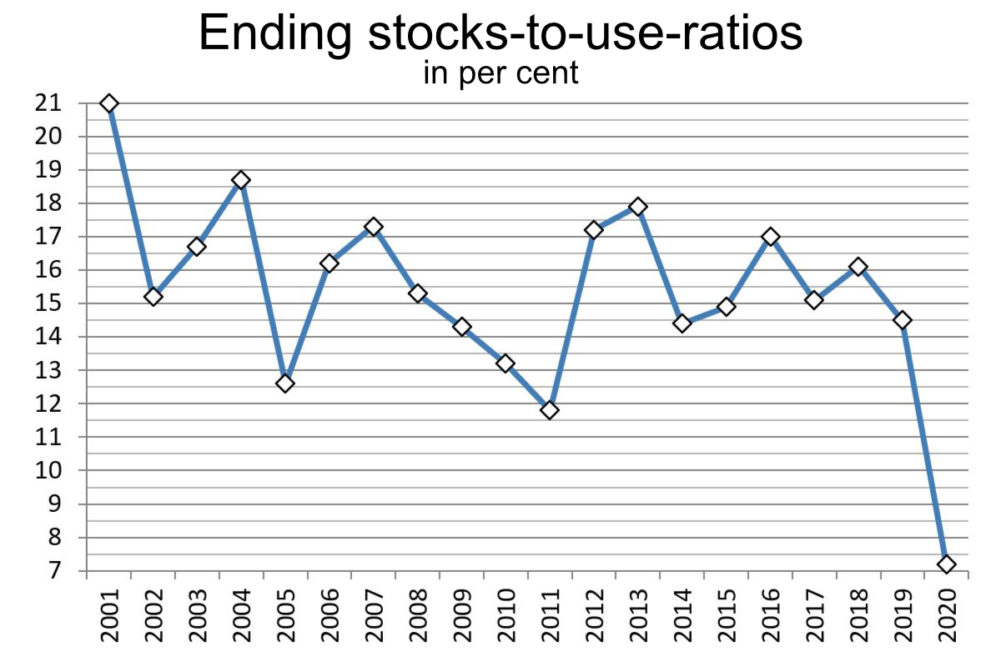

WASHINGTON — The US Department of Agriculture, in its March 10 World Agricultural Supply and Demand Estimates report, lowered forecasts for US beet sugar production and drastically cut forecast imports from Mexico, resulting in an unprecedented 2019-20 ending stocks-to-use ratio of 7.2%, down from 12.4% forecast in February and compared with 14.5% in 2018-19.

US sugar ending stocks were forecast at 887,559 short tons, raw value, down about 628,000 tons, or 41%, from 1,516,000 tons as the February forecast, and down 895,000 tons, or 50%, from 1,783,000 tons in 2018-19.

U.S. sugar production was forecast at 8,031,000 tons, down 126,820 tons from February based on a like reduction in 2019-20 US beet sugar production, forecast at 4,317,000 tons, down 2.9% from February, down 13% from 4,939,000 tons in 2018-19 and the lowest since 2008-09. Cane sugar production was forecast at 3,713,000 tons, unchanged from February but down 8% from last year. Total US sugar production would be the lowest since 2010-11.

Imports from Mexico were forecast at 1,165,000 tons, down 551,844 tons, or 32%, from 1,717,000 tons forecast in February but up 16.5% from 1,000,000 tons a year earlier.

High-tier imports were forecast at 150,000 tons, up 50,000 tons from last month and up 58,000 tons, or 63%, from 92,000 tons in 2018-19, “based on import pace and on favorable margins between US and world refined sugar prices,” the USDA said.

Tariff-rate quota imports at 1,674,000 tons and “other program” imports at 350,000 tons were unchanged from February. Total imports were forecast at 3,339,000 tons, down 502,000 tons from February but up 269,000 tons from 3,070,000 tons in 2018-19. Total US supply was forecast at 13,153,000 tons.

The USDA is required to maintain the US ending stock-to-use ratio at 13.5% under terms of the agreements suspending antidumping and countervailing duties on sugar from Mexico. The shortfall in US supply to get to 13.5%, currently at 768,000 tons, would need to be made up by increases from TRQ, high-tier or free trade agreement imports since Mexico apparently does not have adequate supply to fill US needs.

Total projected use in 2019-20 was unchanged from February at 12,265,000 tons, including 12,125,000 tons for food.

For Mexico, sugar production was forecast at 5,200,000 tonnes, actual weight, down 471,686 tonnes, or 8%, from February and down 19% from 6,426,000 tonnes in 2018-19. If realized, it would be the lowest production in Mexico since 5,048,000 tonnes in 2011-12.

“Analysis based on production through the end of February supports the following projections: area, 780,000 hectares; sugarcane yield, 63.66 tonnes per hectare; and sucrose recovery, 10.466%,” the USDA said.

Mexico’s exports were forecast at 1,030,000 tonnes, down 472,000 tonnes, or 31%, from February, with exports to the United States reduced by 472,287 tonnes to 996,834 tonnes, and exports to non-US destinations estimated at 33,552 tonnes through Feb. 23.

No changes were made from February to 2018-19 estimates for either the United States or Mexico.