Looking back on the past 10 years in the baking industry, it’s been one heck of a ride. When the Great Recession hit in 2008, bakers were growing accustomed to rolling with the punches, having survived challenges like the Atkins craze that impacted so many businesses.

Back then, bakers learned quickly to tighten the purse strings and keep their heads above water, and they proceeded with caution. In fact, when Baking & Snack conducted its 2008 Commercial Baking Capital Spending Study, 63% of respondents indicated they were holding year-to-year capital investments steady or decreasing from the previous year.

What a difference a decade makes. Through the recession, the war on gluten, drastic agricultural changes and bloggers bent on bringing down big food, truly the strong have survived … and they’ll need to flex that muscle in the months and years ahead. Despite the trade war volatility, U.S. bakers have looked at their equipment investments with renewed optimism, according to the 2019 Equipment Trends Survey, a triennial report conducted by Kansas City-based Cypress Research. The survey examined where, why and how bakers are investing their dollars for manufacturing equipment and how it can propel them toward the future.

“Commercial bakers are now looking at how equipment technology can improve their business,” said Marjorie Hellmer, president of Cypress. “They’re not looking at equipment from a day-to-day operational perspective as much as the role it plays in the future of their business. And that’s saying a lot for commercial baking.”

Investing in equipment

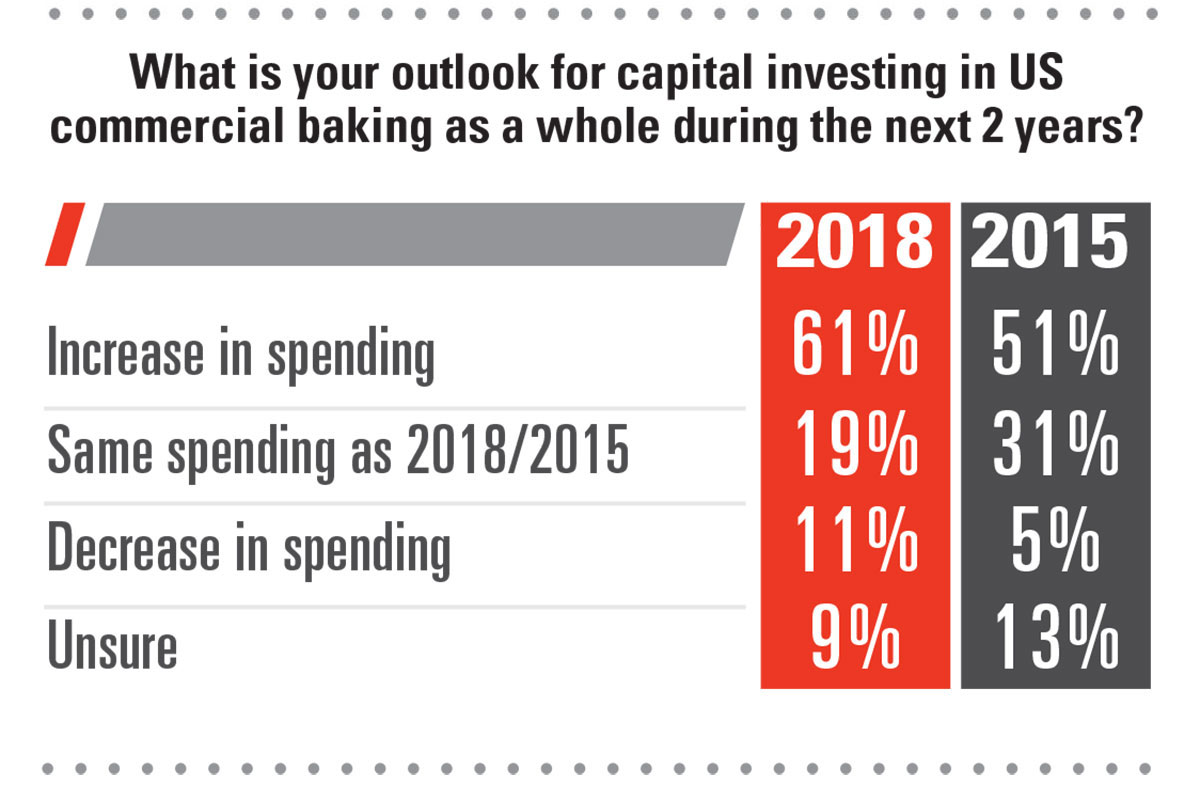

According to this year’s survey, bakers’ optimism toward the economy translated into investment plans. For starters, 61% of survey participants projected an increase in spending for capital investments over the next two years, a 10% increase from the same survey in 2015. Only 19% indicated their spending would stay the same as the current year (2018), as opposed to about a third (31%) of respondents in the previous survey.

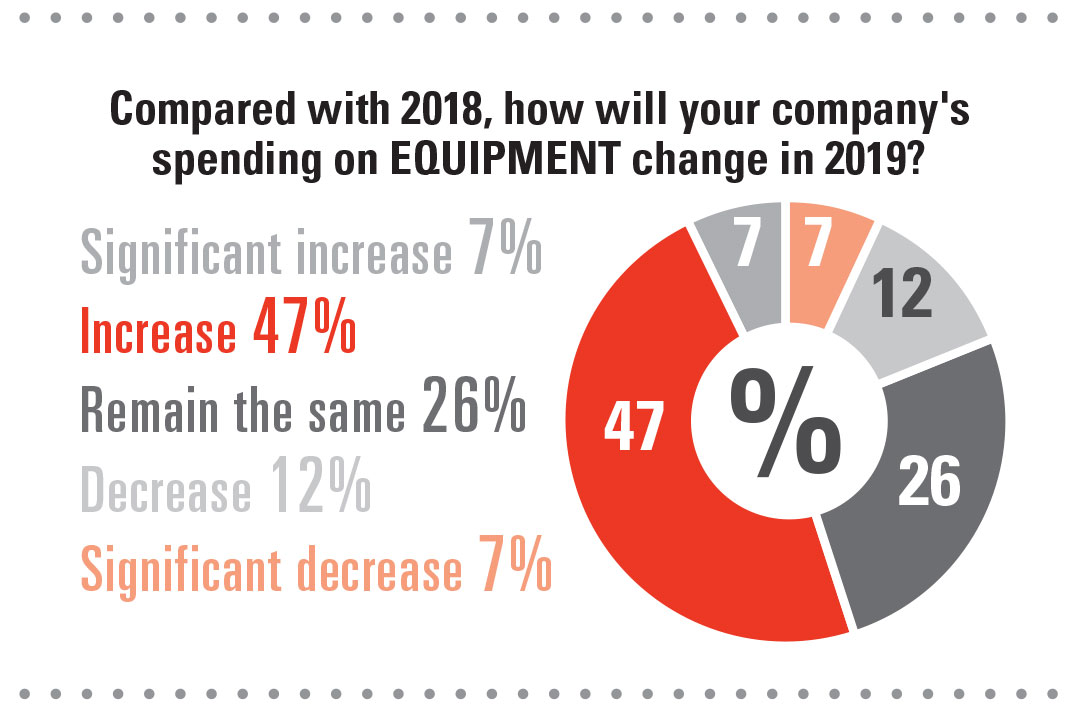

What’s more, in 2018, two-thirds (67%) indicated a year-over-year increase in equipment spending. And of that, 28% identified that increase as “significant” compared with 2017 spending. In 2015 — the last Equipment Trends Survey — it was a mere 8%.

“The industry is at a healthy level,” Ms. Hellmer declared. “When we asked how much spending on equipment changed, more are saying it’s significantly increasing. The outlook has been good over the past several years but with a more moderated level of capital investing. In 2018, we saw what we were hoping to see — a higher rate of positive investments back into companies.”

Strategic spending

So, where, exactly, are the dollars heading?

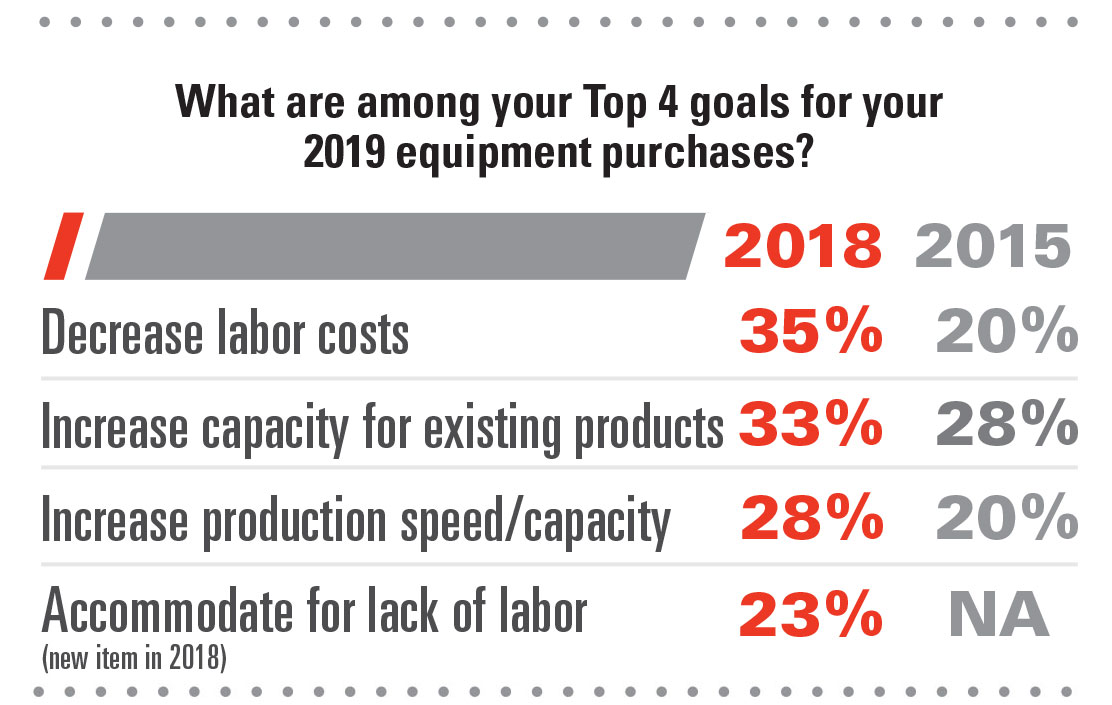

Bakers are targeting investments for the benefit and longevity of their business. Look at the survey’s Top 4 goals for 2019 equipment purchases: decreasing labor costs (35%); increasing capacity for existing products (33%); increasing production speed/capacity (28%); and accommodating for lack of labor (23%).

“There’s a larger proportion of bakeries more sincerely focused on those categories for their end goals than we’ve seen in the past,” Ms. Hellmer observed, noting that in 2015, there was a relatively even spread across a wider number of objectives. These included increasing capacity for new products, improving process capability/flexibility, improving product quality/consistency/accuracy, improved food safety and sanitation, reducing maintenance/repair costs, reducing waste/energy costs, tracking/tracing raw ingredients and finished product, improving food security, and creating more environmentally sustainable operations.

While a certain percentage was dedicated to each of these goals in 2015, the 2018 survey revealed a decrease in all but the Top 5, excluding accommodating for a lack of labor, which was a new question in this year’s report.

“These investments seem more strategic, more proactive than reactive,” Ms. Hellmer suggested. “They’re not responding to something outside their business; they’re improving business from the inside out.”

Bakers are showing that there’s now a clear vision behind how they’re allocating dollars.

“This is future forward, and that’s saying a lot for commercial baking, a typically conservative industry,” Ms. Hellmer said.

For instance, 43% of bakers said they’re considering robotics as their next material handling equipment purchase. This points not only to plans for labor reduction or accommodation but also investing in advanced technology. Only 9% said they had no plans to purchase this type of equipment. Another category — packaging — indicated a mere 9% of respondents weren’t planning to purchase in 2019.

In the packaging area, innovation in case packing equipment and checkweighers each got almost half (47% and 45% respectively) of the attention, and just over a third of participants — 36% for each — expressed interest in metal detectors, robotics and horizontal baggers. Wrappers caught 32% of bakers’ eyes, and labeling technology came in at an even 30%.

It’s clear that — as long as a recession remains a thing of the past — bakers are apt to act on those good vibrations they started feeling in 2015.

Going lean on labor

With any sort of economic outlook, the job market is always a key indicator. Just as the economy was on an upward trajectory the past few years, employment has followed suit … perhaps even more than expected.

That said, issues like the trade war are showing signs that a global economic slowdown could be approaching, as evidenced by Apple’s announcement earlier this year that sales dipped as a result of the China tariffs. AP noted in the same report that U.S. manufacturing posted a steep decline shortly after the first of the year, and a continued slump may be exacerbated in light of China’s recent announcement that the country will raise tariffs on additional U.S. products.

With change on the horizon, some say that the hiring boom and the economic slowdown can’t co-exist for long. However, the fact remains that bakeries are losing workers, regardless of economic conditions. There’s a gap between skilled “dough heads” on the brink of retirement and the significantly fewer entries into the workforce, and the gap is now a reality as opposed to the theoretical possibility it once appeared to be.

Lately, bakers are scrambling to hire skilled workers, scooping candidates up like contestants in a game show cash-grab snagging as many $100 bills as they can get their hands on. It’s a race to fill the jobs, but when they can’t, they’re making strategic equipment investments as a long-term solution in case the labor pool dwindles even further.

For years, we’ve known that equipment can reduce labor costs. But this year’s survey revealed an interesting — yet perhaps obvious — twist. While 35% of respondents indicated “reduce labor costs,” another 23% cited “accommodate lack of labor” among their Top 3 goals for 2019 equipment investments.

Because the latter was a new item in this year’s survey, it was among the top responses, behind increasing production speed/capacity, increasing capacity for existing products and, of course, decreasing labor costs.

As bakers look at capital spending plans, they see equipment as the logical tool to fill the workforce gap.

When it comes to making predictions, though, bakers aren’t prone to show their cards.

“In previous years, they were playing their capex hand very close to the vest,” Ms. Hellmer observed. “But now, companies with a strong foundation are able to look ahead toward the future. They can look with some confidence and say, ‘Here’s what we’re focusing on for the business, and this is how we can become the company that we need to be in the next 5 to 10 years.’”

A look back over the past decade reveals a lot about U.S. manufacturing, American consumers and the baking industry. It also, of course, speaks volumes about the health of the economy.

“This is recovery from the recession,” Ms. Hellmer said. “I think these are the strongest numbers we’ve had so far, and the trend is that we’re hitting our peak. We may slip a little in 2019 and 2020, but not much. We’re still healthy.”