When the coronavirus (COVID-19) pandemic struck, it created a seismic shift in the market that flooded the industry with unforeseen waves of demand for retail products that left many packaging departments under siege. Even the most efficiently designed operations found themselves deluged by requests for family-pack snacks and overwrapped baked goods.

“Many bakers and snack manufacturers have had to completely readjust their product offerings to meet changes in consumer needs — virtually overnight,” observed Teri Johnson, divisional sales manager, TNA.

When restaurants and school cafeterias closed, the demand for prepackaged bakery products swelled, observed Andreas Schildknecht, global product manager robotics and bakery, at Syntegon Technology.

“Even small, local bakery and snack producers have shifted from bulk-supply to single-serve packaging, requiring higher levels of automation to meet higher hygienic standards,” he said.

To accommodate the surge, bakeries shut down entire bulk packing systems as they reconfigured their packaging departments, creating chaos in the short run while prompting them to rethink their long-term capital investment strategies.

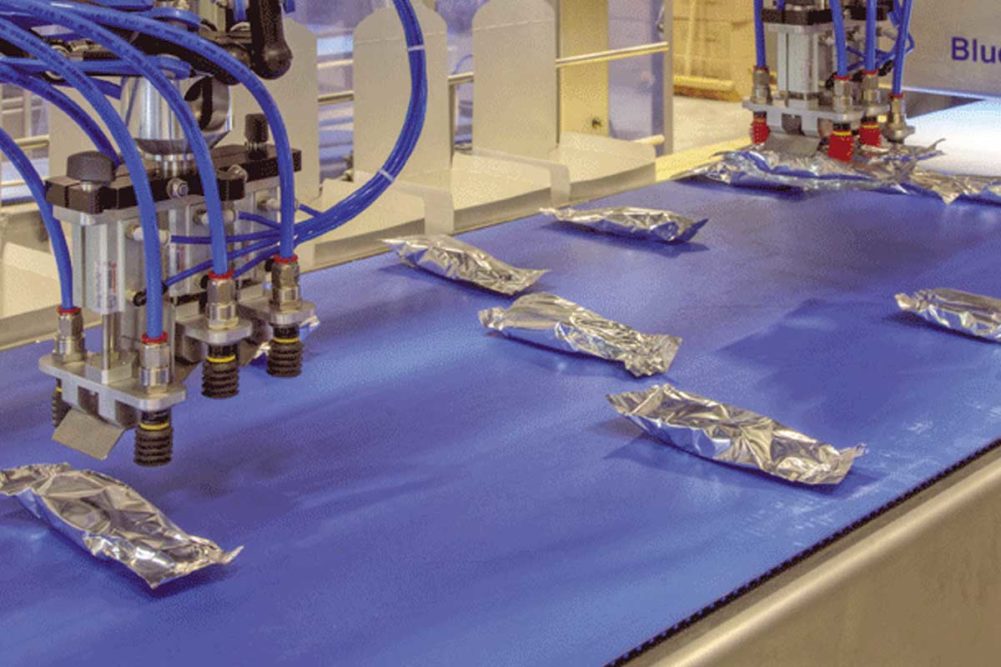

“Bottlenecks occurred at flowwrapping, case erecting, case/tray packing and palletizing,” reported Jason Hogue, southeast regional sales manager, BluePrint Automation (BPA). “Smaller formats translated to higher secondary packaging rates being required to produce the same amount of primary product.”

Mr. Schildknecht pointed out that handling and cartoning individually wrapped baked goods may pose a new challenge, requiring advanced secondary packaging technology such as toploaders.

“Applying new, easy-opening or recloseable features to individual packs may limit manufacturers to specific packaging lines and create more bottlenecks,” he said. “Therefore, reliable and efficient equipment offers a wide range of formats.”

[Related Reading: Putting your operation on automatic control]

For some bakeries, the torrent of change was too much to handle.

“Probably the biggest impact was on the smaller and mid-sized companies,” said Steve McConnell, regional sales manager for Matrix Packaging Machinery, a ProMach product brand.

Others, Mr. McConnell added, also had the luxury of turning to their co-manufacturers. In other cases, an old production line became a new friend that saved the day.

“Many large companies just had to go into a room they hadn’t used or had to fire up an old line that had been sitting around for a couple of years,” he said.

Bill Kehrli, vice president, sales and marketing, Cavanna Packaging, noted that multi-plant companies could shift capacity or simply put the pedal to the metal to ramp up production of high-volume cookies, crackers and other snacks.

“They just ran into some initial problems with the supply chain,” he said. “Instead of running 5 days a week, they started to run 7 days.”

While the initial rush has subsided, many manufacturers are stuck in limbo as the pernicious pandemic prevents some suppliers from installing major upgrades to packaging departments due to restrictions on allowing outside personnel into bakeries and other health concerns. Still, Jeff Almond, industry manager, snack food packaging for Heat and Control, recommended several steps to enact new operational protocols while bridging the gap until new equipment gets delivered.

Perhaps the biggest Catch-22 during the early stages of the pandemic involved adding more labor with new requirements for physical separation and greater operating expenses to ensure workers’ safety.

“During the interim period, bakers can continue to rationalize bag mix and tighten their specifications on corrugated for automation,” Mr. Almond said. “They can also review SKUs for consolidation opportunities to allow for more efficient automation, invest in training tools for existing labor and embrace remote startups and service during these restrictive times.”

With the market’s response to COVID-19, it was the speed of change — and the complexity of the solution — that initially caught many operations off-guard.

“If a baker were running cookies and inclusions into a bulk box, it was simple, but then all of a sudden, they had to make a left turn and put them into trays. That takes months of design and lead time,” Mr. McConnell said. “And when they put bodies in there to do the work, they needed 6 feet of spacing, so the efficiencies just disappeared as they were timing the new packaging with their oven and cooling.”

Mr. Schildknecht said flowwrapping everything inundated many operations and slowed down efficiency.

“Packaging smaller, individual portions creates a bottleneck within the feeder,” he said. “Individually packed products have to be picked and placed into the flowwrapper without harming product quality. Packaging products individually may also be limited by the shape of the product itself, whereas bulk packaging often does not require a specific shape. Single-serve packaging, therefore, requires robotic solutions to feed, align and group the products.”

He added that COVID-19 impacted how bakeries run their facilities in other ways.

“The ongoing pandemic limits the availability of ingredients as well as labor and increases safety regulations,” Mr. Schildknecht said. “Consequently, companies are not only forced to increase hygiene standards but also control their expenses.”

Mr. Almond noted major snack producers first implemented the standard mandated COVID-19 protocols like temperature checks, social distancing and personal protective equipment for employees.

“Next, our customers focused on changing their packaging mix to accommodate the needs of their end-users with a larger emphasis on bigger bags, variety packs and meal kits,” Mr. Almond said. “Some efficiencies are lost due to COVID-19 protocol requirements, but most companies have adapted well to the challenge and realize the importance of the food supply chain. We only have a few customers that bulk pack and ship to a satellite location for packaging. They were already well-versed in food safety protocols.”

{Related reading: The state of the snack industry on 2020]

For those who needed a quick fix as business turned on a dime, automation required more ingenuity as investments were hard to find. Simply put, many packaging companies already had multi-month lead times on orders for new equipment, especially for horizontal form/fill/seal systems

“We had a number of folks saying, ‘I’ve got to have it tomorrow,’ and that’s been the biggest bottleneck for us,” said Dennis Gunnell, president, Formost Fuji. “Our production schedule was already busy and to try to accommodate the new requests while dealing with COVID was a big challenge. Most of our customers are doing individually wrapped because that’s what our machines are perfect for. Some wanted to do more, but normally, that means adding more people. I’ve been impressed with how flexible companies have been because we’re all in a tough situation with COVID. We’re going to have delays and challenges that we have never had before in production, with us as well as with our customers.”

Perhaps the biggest Catch-22 during the early stages of the pandemic involved adding more labor with new requirements for physical separation and greater operating expenses to ensure workers’ safety.

“Many short-run efficiencies were lost from labor shortages and scrambling to implement social distancing protocols, thus requiring more real estate to pack products,” Mr. Hogue said.

Mr. Kehrli pointed out that single-plant bakeries catering to the restaurant industry struggled to place products in clamshells and other packaging.

“They’re scrambling, probably buying used or less-automated equipment, which is the right thing to do at this time but probably not for the long run,” he said.

Mr. Gunnell said others tried to repurpose equipment that had been designed for one product and use it for another.

“Companies are buying machines that were not ideal for their products,” he said. “We have had requests for new applications with our existing machines or requests for used machines. A lot of times, that’s not the best solution, though, because while they can get the equipment they want more quickly, what they often get instead is a bunch of headaches until they automate their line or purchase new equipment that better fits what they need.”

[Related reading: Strategies to rightsize package operations for snacks]

Mr. Schildknecht said band sealers and other systems may offer a short-term solution.

“The first hurdle of individual packaging can be overcome by using pre-made bags,” he said. “Hand-fed flowwrappers are another packaging option for individually packaged portions during the ongoing pandemic.”

In some bakeries, Mr. Kehrli observed, bottlenecks include a combination of complications.

“The first bottleneck is literally the space of the building, and the second is the short runs and changeovers that the smaller bakers need,” he said.

Cavanna offers the Twin Slim wrapper, which puts two wrappers in the footprint of one. However, Mr. Kehrli said space-saving equipment is most effective when it’s part of a larger, turnkey solution.

“They don’t have the resources and the time now, and they underestimate the value of a true-engineered start-to-finish solution,” he said. “In most instances, smaller bakeries are less competitive because of all the labor that they have to put into packaging, their products end up costing more than factory-made products. We can automate anything, but if there isn’t enough space, then it becomes challenging.”

Mr. McConnell said Matrix offers a “stock” machine program that has helped snack manufacturers ramp up production on their vertical form/fill/seal lines. Moreover, ProMach’s TYJ automatic pouch units also offer a quick alternative by relying on premade packaging to fill pretzels, trail mixes and other types of snacks.

This article is an excerpt from the September 2020 issue of Baking & Snack. To read the entire feature, click here.