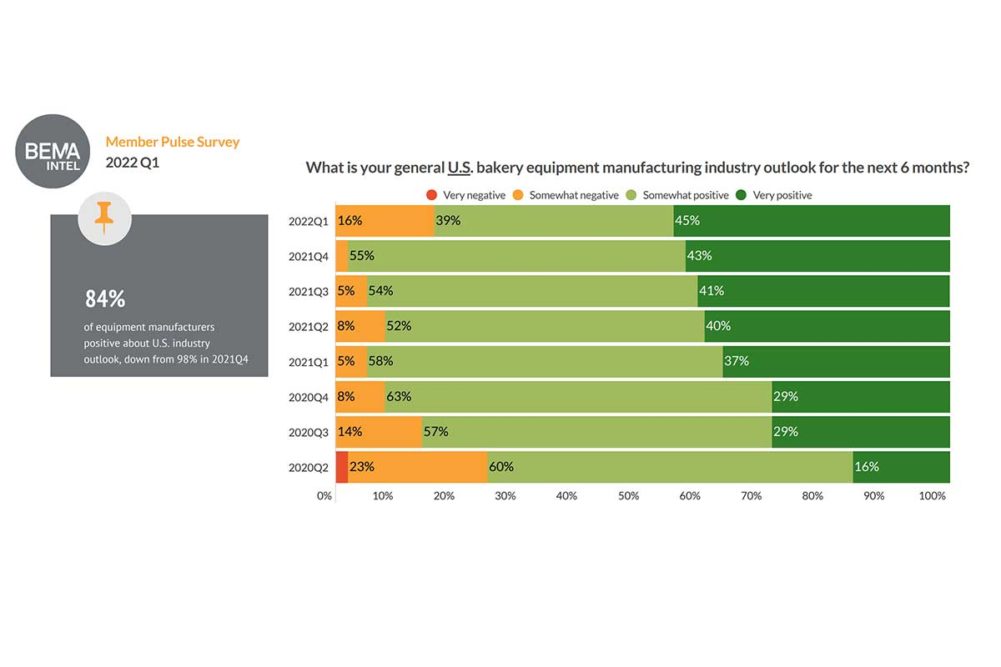

Slowly but surely, the baking industry appears to be evening out. That’s what the latest data from BEMA Intel seems to suggest. In the quarterly Member Pulse Survey for Q1 2022, 84% of equipment manufacturers reported a positive outlook for the baking industry in the United States. That percentage has been hovering near 100% for the past few quarters.

“The survey confirms that there is a positive outlook for our industry,” said Jason Ward, president of AMF Bakery Systems and BEMA board member. “We are coming off these quarters of strong demand for equipment with lots of projects in the pipeline, and we’re not going to keep that pace forever as an industry. So we are seeing a natural softening.”

When asked about quarterly bookings, 59% of equipment manufacturers reported bookings were up compared to last quarter. In Q4 of 2021, that number was 64%. For Q1 of 2022, 16% of members reported bookings were down compared to last quarter.

Mr. Ward was quick to point out, however, that this dip in positivity for the industry is not likely due to a dip in demand but a natural response to the immense amount of pressures the industry is currently facing. Costs related to raw materials and transportation and logistics are far outpacing other concerns listed in the data. Concerns related to the coronavirus (COVID-19) pandemic have dropped from 65% in Q4 of 2021 to 24% in Q1 of 2022.

These pain points are also reflected in the BEMA Intel Industry Indicators, which show prices skyrocketing. Bakery ingredient indices jumped up drastically from Q4 2021 to Q1 2022 in all products except pasta. Saltine crackers, white pan bread and shortbread cookies experienced the most drastic increases.

Other input costs are also rising and more significantly than before. Diesel fuel prices jumped from just more than $3.50 to more than $5.00 within weeks. While unemployment is down overall, the cost of labor per unit is up 6.6%, which compounds on previous increases.

“It’s still a story of a squeeze,” said Jennifer Lindsey, vice president of global marketing, Corbion. “That has not changed unfortunately and because of the new wrinkles of the conflict in Ukraine, that already adds more stress to a stressed supply chain.”

The good news, she said, however, is that bakers can pass these costs onto the consumer. The consumer price index for bakery products in March was up 9.1% compared to March 2021. And that number is catching up with the 10% increase in CPI for all food at home. This didn’t impact consumer demand during the first quarter either as IRI data for the period shows that in general, bakery unit sales remain steady even as prices are increasing dollar sales.

“Consumers aren’t running away from bakery products because of high prices,” Ms. Lindsey said. “When you compare bakery to overall food categories, it’s one of the most cost-effective ways to feed your family. Food is something you can still splurge on in a recessionary period.”

This consistent demand and the recession-resistant nature of bakery is what Tim Cook, chief executive officer of Linxis Group and BEMA chairman, attributes the persistent positivity to.

“My experience is that bakers are being cautiously optimistic,” he said. “Demand for bakery products remains strong and supply continues to be challenged. During inflationary periods people are not likely to buy less bread from retail outlets. They may switch from a premium brand to a less expensive brand of bread, and they may eat at home rather than going out to a restaurant which affects some categories worse than others, but bread is still one of the most economical and meal efficient forms of food available for consumers.

Whether demand remains high as prices rise remains to be seen in future BEMA Intel reports.