DŰSSELDORF, GERMANY — A chronic shortage of labor coupled with a lack of skilled applicants is sparking the sustained spending spree on automation and new equipment, and many companies expect the labor dilemma to continue for the foreseeable future.

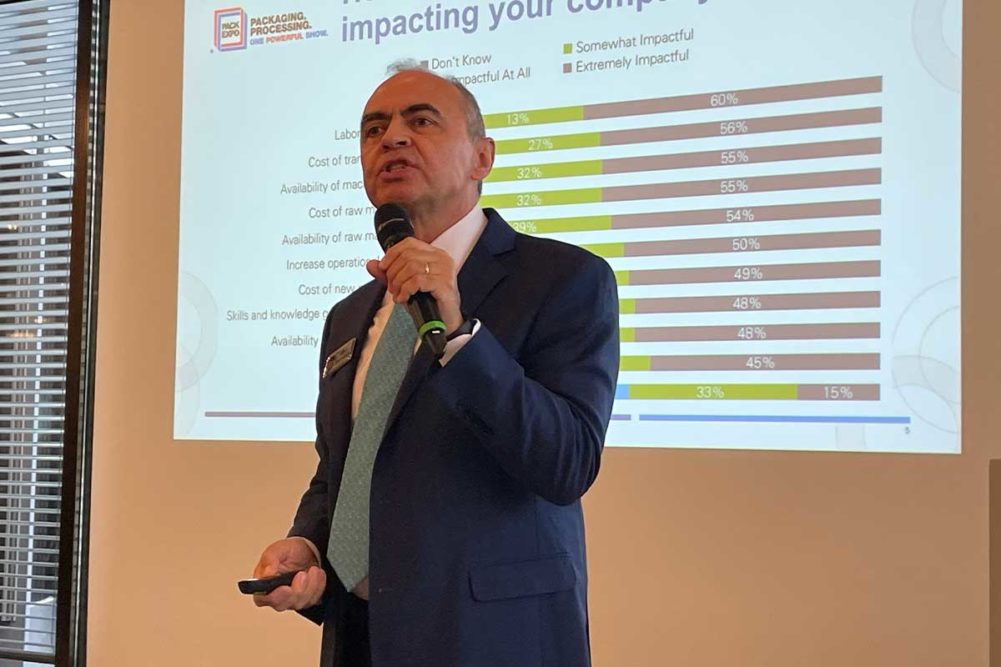

“Workforce is No. 1 by far,” said Jorge Izquierdo, vice president, market development, for PMMI, the association for packaging and processing technologies. “Its availability and the gap in terms of knowledge and experience is the No. 1 driver in automation.”

Mr. Izquiedo summarized PMMI’s recent report on “The Future of Automation in Packaging and Processing” during interpack 2023 and provided Baking & Snack with additional insights after his presentation.

The report showed that 60% of consumer packaged goods (CPG) companies cited the labor shortage as a significant driver for automating their operations. As a result, 31% of those surveyed indicated they were deploying automated machinery on production lines as a substitute for manpower and would continue to do so.

While this pain point has been felt across the globe, PMMI reported that it’s especially acute in Germany where the Institute of Employment research projects the nation’s potential workforce to fall by 7 million people by 2035.

However, investing in automation and getting new equipment are two separate challenges, Mr. Izquierdo said. Although supply side issues have subsided in some areas, many OEMs noted that processing components and key electronics are still hard to come by, especially in a timely manner.

During the trade show, many exhibitors told Baking & Snack editors that the issue is especially acute with the most popular and widely used components preferred by North American companies, although other global providers have ramped up their supply chain.

When asked about the issue, Mr. Izquierdo said he’s heard similar responses.

“They’ve sometimes invested hundreds of thousands of dollars in specific equipment and one small piece that’s cost them a few hundred dollars is keeping them from completing the delivery,” he said.

In some cases, exhibitors said they have delivered equipment without the key processors, which ties up valuable cash flow because CPG customers often won’t pay the full amount until the equipment or production line is fully operating in a satisfactory manner.

However, there is positive news.

“Fortunately, we’re finding that delivery times are starting to get shorter,” Mr. Izquierdo said. “Delivery times are much better, but they’re still not yet normal.”

Since 2020, sales of packaging equipment had soared to record levels, even to double-digit spikes in some years compared to more historic norms of 4% to 5% increases. Mr. Izquierdo said he expects 2023 sales levels to be higher than average, but lower than the recent big jumps. PMMI will officially update its packaging equipment sales data with its state-of-the-industry report later this year.

During his presentation, Mr. Izquierdo said the growth in e-commerce is also fueling the push for greater automation in packaging. Nearly half of CPG respondents reported that the expansion of e-commerce is impacting their business, which is increasing the need for greater flexibility in packaging operations to accommodate rapidly changing consumer preferences.

“Continuing labor shortages and e-commerce growth represent shared challenges among CPGs operating in the United States, Canada and much of Europe,” Mr. Izquierdo said. “However, the resulting interest in automated solutions as a remedy has accelerated adoption and carved new paths in collaboration and creative problem-solving between these companies and OEMs to fuel greater efficiency, productivity and cost-efficiency."

Companies are also relying more on robots and cobots to alleviate workforce challenges, he added. More than 90% of survey respondents believe that robots and cobots have assisted with labor shortages, with 27% reporting they are deploying them in their plants. That percentage is expected to rise to 57% during the next five years.

Streamlining maintenance is another motivator for automating processing and packaging departments. Forty-three percent reported using predictive maintenance technology on their lines while 83% were considering it. Similarly, 56% of those surveyed indicated they have used remote maintenance since 2020. About 25% rely on 3D printing to make and replace nonmoving parts that are prone to wear and tear.