WASHINGTON — Changes for sugar in the US Department of Agriculture’s Feb. 8 World Agricultural Supply and Demand Estimates (WASDE) report mostly were in line with trade expectations with domestic beet sugar production and imports from Mexico lowered, high-duty imports raised and domestic deliveries for food use lowered, resulting in higher ending stocks and a higher ending stocks-to-use ratio.

Mexico remained a focus of the industry as sugar production in that country has been reduced by drought for a second consecutive year. The USDA forecast 2023-24 sugar production in Mexico at 4.875 million tonnes, actual weight, down 141,000 tonnes, or 2.8%, from the January forecast and down 349,000 tonnes, or 7%, from 5.224 million tonnes in 2022-23. The USDA’s forecast of Mexican sugar production has been lowered by 925,000 tonnes, or 16%, since September and would be the lowest since 2009-10 if realized. Imports by Mexico were forecast at 547,000 tonnes, up 36,000 tonnes, or 7%, from January and up 262,000 tonnes, or 92%, from last year. Domestic sugar use unchanged from January at 4.648 million tonnes. Exports were lowered by 105,000 tonnes, or 13%, to 709,000 tonnes in 2023-24. Ending stocks were unchanged from January at 900,000 tonnes.

Analysts had anticipated lower production and export forecasts for Mexico, with some trade estimates still below those of the USDA.

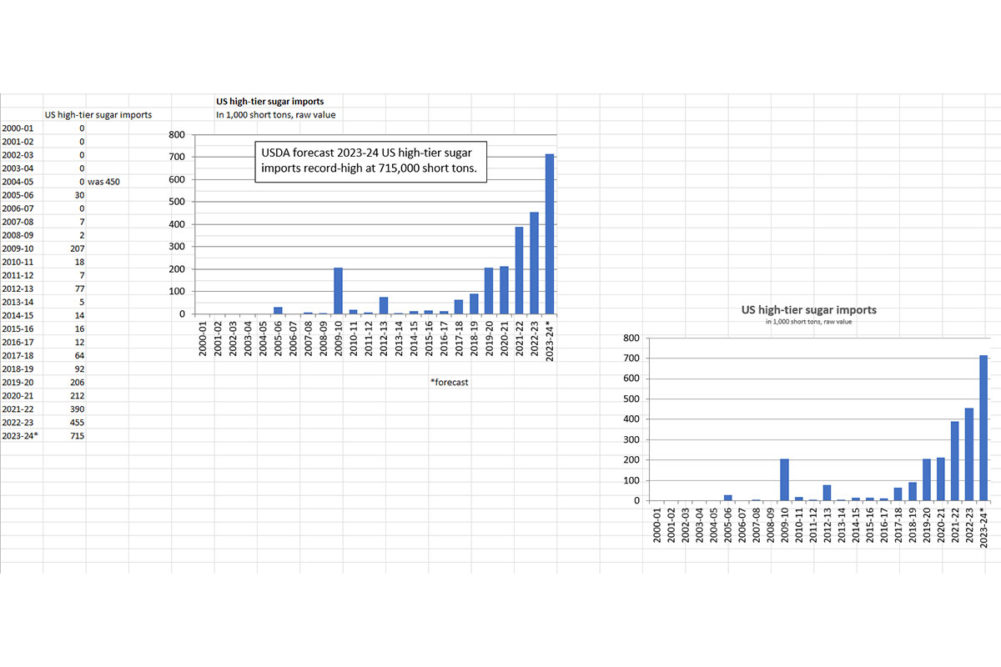

Despite the decline in imports from Mexico, total US sugar imports were raised 16,462 short tons, raw value, from January to 3.326 million tons. Tariff-rate quota imports were nearly unchanged at 1.612 million tons. Imports from Mexico were forecast at 799,000 tons, down 123,000 tons, or 13%, from January and down 357,000 tons, or 31%, from 2022-23. More than offsetting were high-duty imports, forecast at a record 715,000 tons, up 140,000 tons, or 24%, from January and up 260,000 tons, or 57%, from last year. The USDA expects high-duty imports to consist of 475,000 tons of raw sugar and 240,000 tons of refined sugar.

High-duty imports tend to be the highest-priced sugar available in the US market. Because of the seeming dependence on high-priced high-duty sugar imports to offset the loss of lower-priced imports from Mexico, refined sugar prices likely will be supported despite record-high domestic sugar production.

Domestically, the USDA forecast 2023-24 US sugar production at 9.352 million tons, down 39,000 tons from January based on beet sugar production of 5.327 million tons, down 79,297 tons, and refined cane sugar at 4.024 million tons, up 39,000 tons. The lower beet sugar number was the result of estimated higher beet pile shrink, which was expected. The higher cane sugar forecast was the result of higher production in Florida and Louisiana. If realized, beet sugar and total sugar production still would be record high.

Total 2023-24 sugar supply was forecast at 14.520 million tons, down 23,392 tons from January and down 165,000 tons from 2022-23.

Sugar deliveries for human consumption were forecast at 12.450 million tons, down 75,000 tons from January and down 23,000 tons from 2022-23. Exports and “other” deliveries were unchanged from January at 160,000 tons and 105,000 tons, respectively. Total sugar use was forecast at 12.715 million tons, down 75,000 tons from 2022-23.

The drop in sugar deliveries for food use was expected amid reports of slow shipments of contracted sugar over the past few months.

Lower forecast deliveries more than offset the small decline in total sugar supply, resulting in forecast ending stocks of 1.805 million tons in 2023-24, up 51,608 tons from January but down 38,000 tons from last year. The ending stocks-to-use ratio was raised to 14.2% from 13.7% in January but was slightly below 14.3% in 2022-23.