| Sign up for our free newsletters From breaking news to R&D insights, we’ll send you the top stories affecting the industry. |

Subscribe |

Knowing what consumers want, and what they respond to positively, has always been crucial for food marketers. Manufacturers’ product development and marketing efforts are often guided primarily by a recognition of buying trends in the market. But a deeper understanding of what’s driving consumer desires and behaviors may help food companies anticipate where those behaviors are leading the industry.

That was the motivation behind a global consumer research initiative conducted by Corbion’s Global Market Insights group. More specifically, this research explored the long-term effects of the global pandemic on consumer perceptions and behaviors around the foods they eat.

The research involved in-depth interviews with 54 consumers representing 9 countries and a wide variety of demographics, including different life stages, lifestyles, socio-economic groups and family dynamics. Participants were asked about their key challenges, their perceptions regarding food and food manufacturing, key motivators that shape their attitudes about food, as well as their thoughts about the future of food in the wake of the global COVID-19 pandemic.

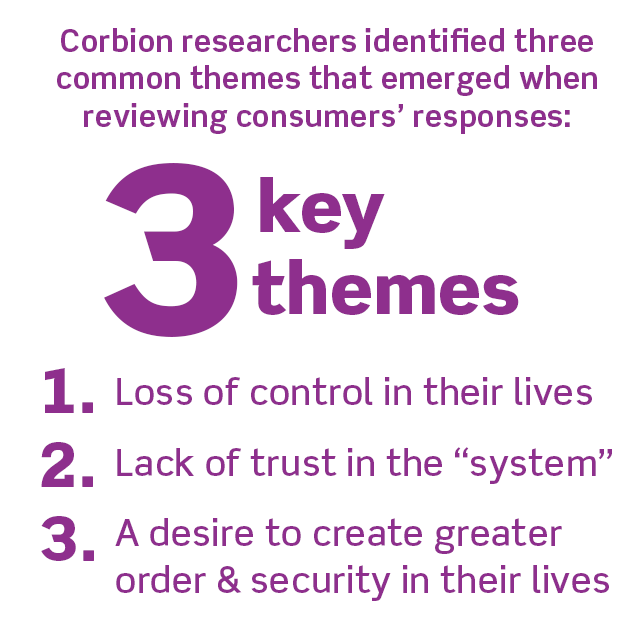

Corbion researchers identified three common themes that emerged when reviewing consumers’ responses: 1) Loss of control in their lives; 2) Lack of trust in the “system”; and 3) A desire to create greater order and security in their lives.

Source: Corbion

Source: CorbionConsumers felt a general “loss of control” after many months of headline-grabbing black swan events – extremely unpredictable, negative events. As COVID infection rates continued to rise, people’s health concerns – for themselves and for their loved ones – became bigger than ever. Many lost friends or loved ones and couldn’t even attend their funerals. Health risks made physical separation and isolation a part of everyday life.

“One of the outcomes of so many people feeling their lives largely derailed was an increased focus on doing what they could to control their own health, particularly around the foods they ate,” says Megan Passman, Global Insights Manager at Corbion, who contributed to the study. “A big part of that for many people involved looking more closely at the links between health, diet, and lifestyle.”

The pandemic’s devastating economic impacts added financial insecurity to consumers’ burdens, as many lost their jobs, and companies scrambled to adapt their business models and operations to the realities of the lockdown. Nearly everyone found supermarket shelves empty, and when they could find the products they needed, they felt the pressures of rampant inflation.

Working parents struggled to balance the demands of the virtual workplace and their children’s virtual classroom. The ability to celebrate important life events in recognizable ways was taken away – weddings, birthdays, graduations. Consumers felt a powerful desire to regain more control over their own lives.

With this sense of lost control, consumers also felt a growing lack of trust, now questioning aspects of life they had always taken for granted. Public health concerns reached previously unimaginable extremes; authorities and institutions could no longer be counted on to keep them safe. For many, a lack of trust had evolved into active distrust … of governments, big business, food manufacturers, and others in positions of power.

Given the widespread feeling of vulnerability among consumers regarding their health, it’s not surprising that some of their growing mistrust focuses on the foods they eat, as most recognize nutrition and diet as being foundational to human health. It is this mistrust that drives a growing number of consumers to study food product labels and shy away from products containing unfamiliar ingredients with chemical-sounding names. "Food safety, quality, and freshness will always be important. Opportunities where food manufacturers could better educate consumers in this area will be critical and beneficial,” Ms. Passman said.

Climate change, geopolitical conflicts, a global pandemic, fake news, and other ominous facts of life today have consumers yearning for things that increase their feelings of security. Concerned about the state of the world and the health of the planet, they are increasingly conscious of the importance of sustainability, equating it with the importance of the natural world on which human existence depends.

When it comes to food, consumers told Corbion researchers that they consider more “natural” foods are better quality foods. They also look for products whose manufacturers are trying to “do the right thing,” conducting their businesses in ways that respect the importance of conserving natural resources. Along with these priorities, convenience continues to be highly significant, as consumers strive to find more time in their busy lives for the things they value most – being with their loved ones.

Source: Corbion

Source: CorbionWith consumers reevaluating their relationships with food and the brands they choose, there is an opportunity for manufacturers who can help satisfy the desire for greater control and value propositions that build trust.

Creating and marketing products that emphasize health while delivering quality and convenience give shoppers the sense of control over their lives they want more of. “Replacing synthetic, ‘chemical-sounding’ ingredients with more natural, label-friendly alternatives increases transparency and gives consumers products they can better understand, trust and enjoy,” Ms. Passman added.

In a time when consumers are keenly aware of the fragility of life, they see healthy food, sustainably and responsibly produced, as essential to preserving it. When manufacturers communicate, through words and actions, a commitment to those same ideals, their customers sense a kinship – a partnership – that inspires brand loyalty. Sustainable brand loyalty.

| Sign up for our free newsletters From breaking news to R&D insights, we’ll send you the top stories affecting the industry. |

Subscribe |

Offerings from Mondelez, Kellanova and more are available now.