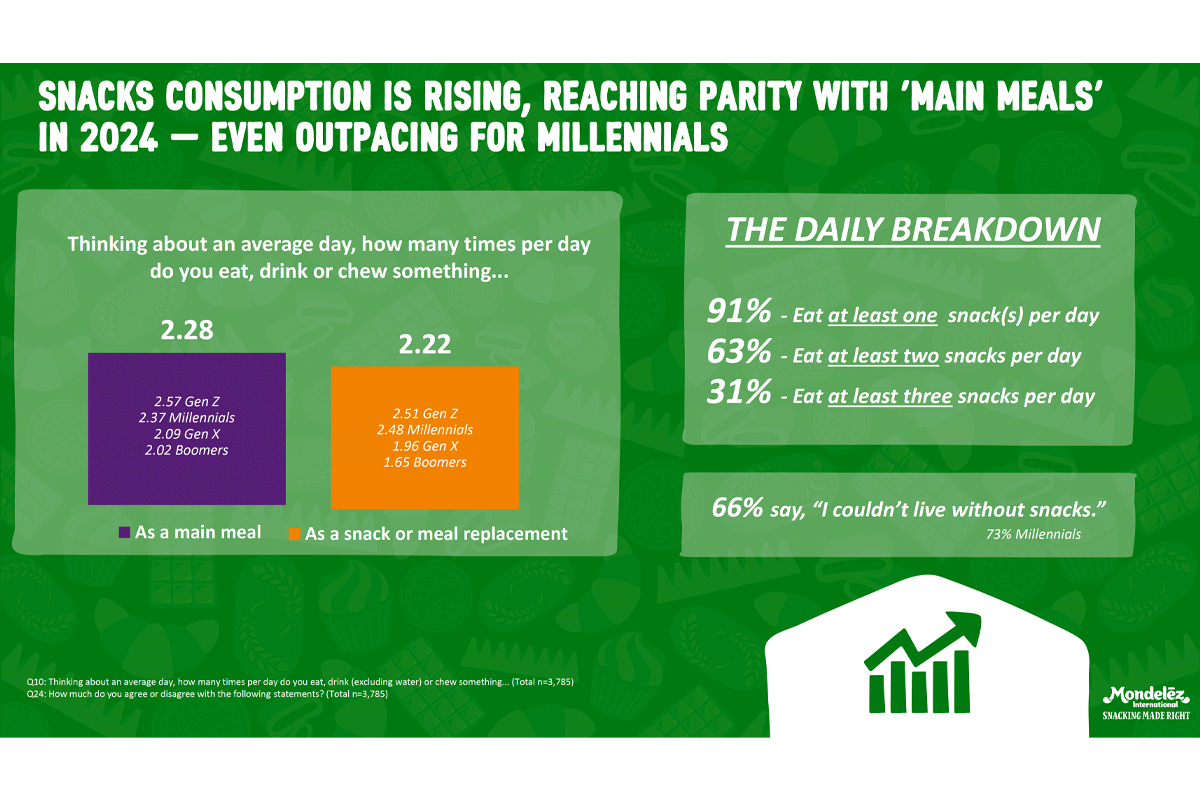

CHICAGO — Snacking remains a linchpin of eating habits around the globe, with almost all adults eating one snack daily and nearly two-thirds consuming two snacks per day, according to Mondelez International’s 2024 State of Snacking study.

Of 3,785 adults in 13 countries surveyed by The Harris Poll for Mondelez, 91% said they eat at least one snack each day, with 63% munching at least two snacks and 31% consuming at least three snacks daily.

The poll also revealed people’s strong urge to snack, as 66% of respondents agreed that “I couldn’t live without snacks.” Indeed, consumers said that on average they “eat, drink or chew something” 2.22 times per day as a snack or meal replacement, nearly as much as the 2.28 times daily as a main meal.

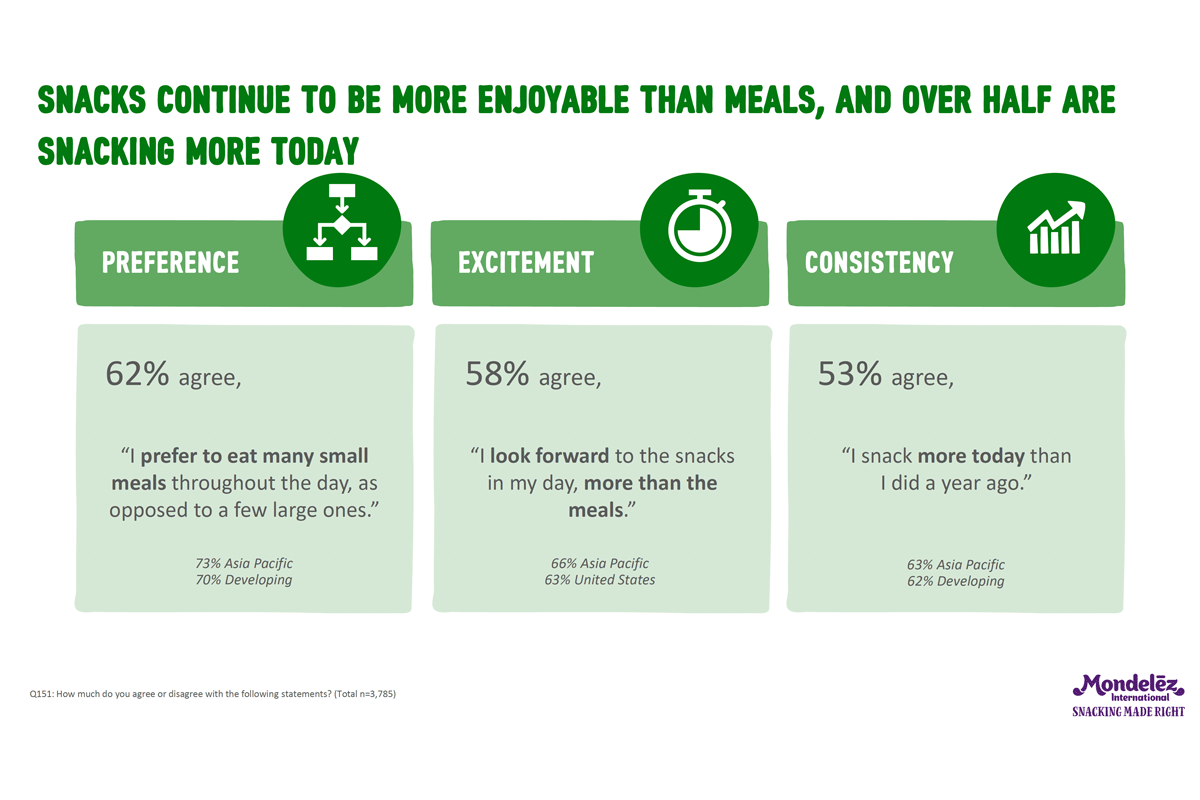

For more than half of survey respondents, snacks prove to be more enjoyable than meals. Fifty-eight percent said they look forward to snacks more than meals each day, and 62% prefer to eat many small meals throughout the day instead of a few large ones. Overall, 53% said they snack more today versus a year ago.

Younger consumers tend to be bigger fans of snacking. Among Gen Z/millennial respondents, 65% snack more today than a year ago (versus 36% of Gen X/boomers), 71% favor eating more small meals throughout the day (versus 50% of Gen X/boomers) and 67% look forward to snacks more than meals (versus 46% of Gen X/boomers).

By time of day, snacking among those polled has stayed consistent in the morning. Yet the share of consumers saying they snack in the afternoon rose to 70%, up five percentage points from last year, while 52% said they snack in the evening, up four points. Most respondents seek an energy boost, as 76% agreed that “snacking gives me a much-needed pick-me-up throughout my day.” That percentage was more pronounced in North America (81%) and Asia-Pacific (82%).

What snacks are consumers buying and where?

Biscuits/cookies and chocolate remain staple snack choices of consumers worldwide, Mondelez’s study showed.

In the 13 international markets polled, 66% of adults said they eat biscuits/cookies on a weekly basis or more frequently, up five percentage points from last year. Among the nations surveyed, the United States (54%), Canada (59%), Germany (50%), France (59%) and China (59%) were lower in the pack of global markets whose consumers eat biscuits/cookies at least weekly, compared with the United Kingdom (71%), Mexico (69%), Brazil (72%), India (84%), the Philippines (87%), Indonesia (71%), Vietnam (61%) and Australia (60%).

Likewise, 73% of adults surveyed agreed they “can’t imagine a world without chocolate,” up 6% from a year ago. That percentage was even higher in the US (79%) and the UK (80%).

Chocolate snacks meet consumer needs for indulgence, Mondelez noted. Among the options offering an opportunity to indulge, respondents cited chocolate bars (82%), milk chocolate (80%), cookies (79%), chocolate-coated nuts/dried fruit (75%), ice cream sandwiches (72%), dark chocolate (72%), crackers (65%), caramel popcorn (65%), granola bars (61%) and pretzels (60%).

While grocery retailers remain a core venue for snack purchases, the survey results indicate shoppers are getting their snacks from other locations. Respondents said they bought snacks in the last 12 months at convenience stores (77%), malls/shopping centers (74%), rest stops (60%), movie theaters (58%), online (54%), gas stations (50%), train/bus stations (47%), sports venues (44%) and airports (43%), as well as on the way to/from work (61%).

Online has continued to grow as a retail destination for snacks. Consumers surveyed said they now buy 25% of their snacks online versus 75% in-store. However, when asked about where they expect to purchase snacks a year from now, respondents said 32% online and 68% in-store.

Meanwhile, the current economic environment is pushing many consumers to adjust their snack-buying habits. To reap savings or get more value, those polled said they have done or plan to do the following when purchasing snacks: bought from a specific store due to sale prices (80%), bought fewer than normal (75%), bought lower-price off-brand counterparts (71%), used coupons (70%), bought at a dollar store (68%), bought in bulk at a bulk foods/surplus grocery store (67%), bought items with a short shelf life at a steep discount (65%), bought online via a third-party vendor (60%), bought in bulk online (58%) and enrolled in a store membership to access particular snacks (54%).

Still, the consumers surveyed expressed strong loyalty to particular snacks and brands. Across the international markets polled, 80% said they have longtime loyalty to certain snacks/brands. The United States, UK and Vietnam were at the 80% global average for snack/brand loyalty, while Brazil (78%), Australia (77%), Canada (76%), Germany (72%) and France (68%) were below the average. The most loyal snack/brand consumers were in Indonesia (89%), the Philippines (88%), India (88%), China (81%) and Mexico (81%).

Source: Mondelez International and The Harris Poll

Source: Mondelez International and The Harris Poll One factor behind such loyalty could be that snacking habits are enduring, according to Chicago-based Mondelez. In the survey, 66% of consumers said they still follow their childhood snacking habits, and 73% agreed that “certain snacks my family eats have been passed down through many generations.”

“Rather than declining, snacking is evolving to meet inflation,” the report said. “While 59% have had to change snack purchasing habits due to inflation, the vast majority (94%) can find a snack that fits within their budget.”

And smaller portions and pack sizes aren’t discouraging consumers from buying their snacks. Seventy-one percent of those surveyed agreed they will “keep snacking through shrinkflation” as long as the quality is upheld.

Indulgence competes with wellness

Consumers continue to take a double-edged approach to snacking by satisfying needs to indulge and to promote nutrition and wellness, the study findings show.

Forty-eight percent of those polled said they eat snacks to “pamper/spoil/reward myself,” while nearly the same percentage (45%) do so to “take care of my body/for my nutritional needs.” Similarly, 48% snack “for a sense of comfort” and 43% consume snacks to “stay alert/energized.”

Snack manufacturers’ innovation efforts are well-aligned with consumers’ desire to enjoy something different when they snack. In the survey, 95% of respondents said they savor the flavor, taste and texture of their snacks, and 94% said they eat snacks as a treat. Just over eight in 10 (81%) of consumers polled agreed that they “pay attention to the sensory experience of my snacks.” In turn, 94% said they’re able to find snacks offering a unique taste and flavor.

But there’s no doubt that consumers today are paying more heed to health and wellness when it comes to snacks, according to the study. Thirty-eight percent of respondents agreed that, in the past year, they’re more likely to pay attention to ingredients beneficial to their health when snacking, versus 25% being more focused on ingredients they’re trying to avoid.

Along the same lines, 74% of those surveyed prefer snacks with high nutrition quality, and 78% prefer brands prioritizing quality ingredients over calorie counts.

And while 69% of consumers said they seek portion-controlled snacks and 38% agreed that snacks should be enjoyed in moderation, 73% admitted they would “rather have a smaller portion of an indulgent snack than a bigger portion of a low fat/sugar alternative version.”